CreditWiseAR

How can augmented reality (AR) be used in a bank? With CreditWise AR, my team at Capital One created an experience to teach customers about the important but mundane topic of credit scores. Customers learn about credit through the life moments of different characters and how each step in life can affect their credit score.

Intro

I led the project after an initial prototype of the AR experience was developed. I improved the build through several iterations and released a pilot build with a hundred users. Through managing business partners and my development team I improved the prototype but still found it to be fundamentally flawed. At the end, I made the decision to phase out the project. From my experience I proposed new projects and shared my learning company-wide.

My Role

Project Lead

I learned how to manage and sell a project among senior-level stakeholders in a large company. I also managed the development process with our external vendor including their tech lead and software engineer.

Experience Design

I designed an augmented reality experience for the iPad and iPhone within our café branch spaces. This included interactions and content that made the experience more engaging and educational for its users.

User Research

I created and executed user research testing in four different locations with over fifty customers and fifteen bank associates. For each testing session I analyzed interviews and statistics. This analysis was shared with my product owner and key in making design decisions.

Team

5 people (3D artists, engineers, product owner)

Research: Testing in the Capital One Café

The core goal of CreditWise AR is to teach customers about credit scores in our Capital One Café. The Capital One café is a modern banking space where customers can learn about their finances.

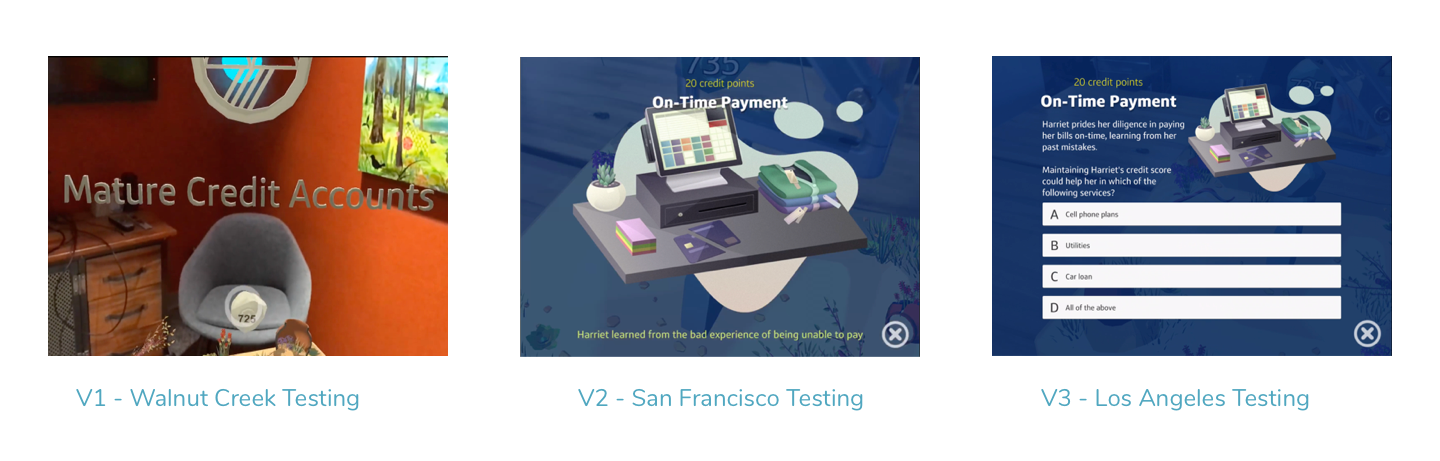

I ran user-testing studies across our west coast locations to observe how customers reacted to the initial prototype. It was also important to see how our branch associates reacted to the prototype, as they would be the leading customers through the experience.

Customers were impressed with the production level of the graphics and audio of our experience. One customer I tested in Glendale, CA stated, “Wow, I didn’t realize it was going to be a full on AR experience”.

But beyond the initial wow factor, I found major flaws in the experience that I wanted to improve. The experience was ill-suited to its use case and wasn’t able to hook in customers at its current state. I designed improvements to the experience and worked with our partners Whamix, an external 3D development studio to implement these changes.

Improvement 1: A better physical and digital experience

The experience was never previously tested in its context of use. In the Capital One café, dialogue audio of the experience was hard to hear over the sound of coffee machines, customers conversing and store music being played. Users enjoyed exploring the 3D environment, but couldn’t hear the lessons about credit scores well.

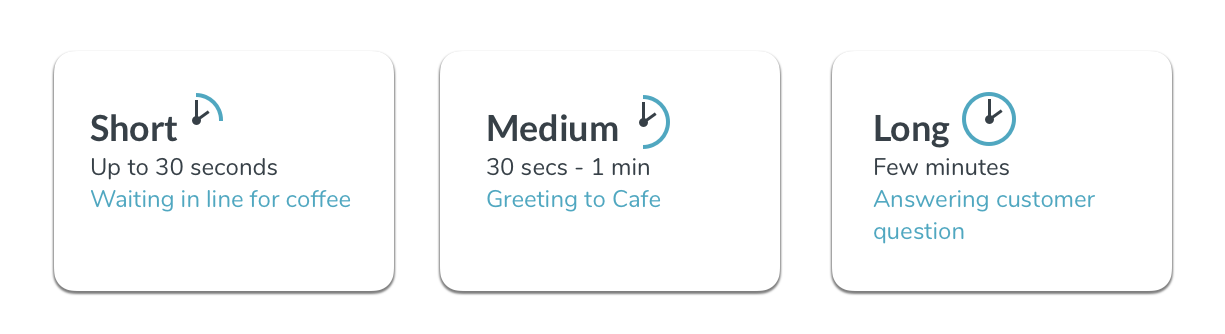

Furthermore, customers commented that the experience was far too long. Our branch associates reiterated this problem, saying that most customers would not have the time to go through the entire experience. Mason, one of our long-time associates, taught me that their conversations are thought in three lengths – short, medium or long. Each conversation length applies to different scenarios for a customer, from asking a quick question to receiving longer advice.

I added the ability to skip the introduction and a menu where customers could skip to various portions of the experience. This way, the ambassador hosting the experience could tailor the length of the interaction as they saw fit according conversation lengths.

To better articulate each lesson, I added subtitles and title cards to explain visually. Along with this I shortened each dialogue so it was straightforward and to the point.

Customers in our next round of testing were able to follow and understand the narrative behind our experience better. One of our customers Gloria told me how she related to the story behind one of our characters, Jill, as she had also recently moved across country and was learning how to protect her credit during this time of her life.

Improvement 2: Giving customers an educational takeaway

A common reaction among initial testers was that they were not sure what the point of the experience was. We would show life moments that affected each character’s credit score but the experience did not propose any solutions. One of customers asked me, “Are you going to have solutions for these people? Have solutions & resources”.

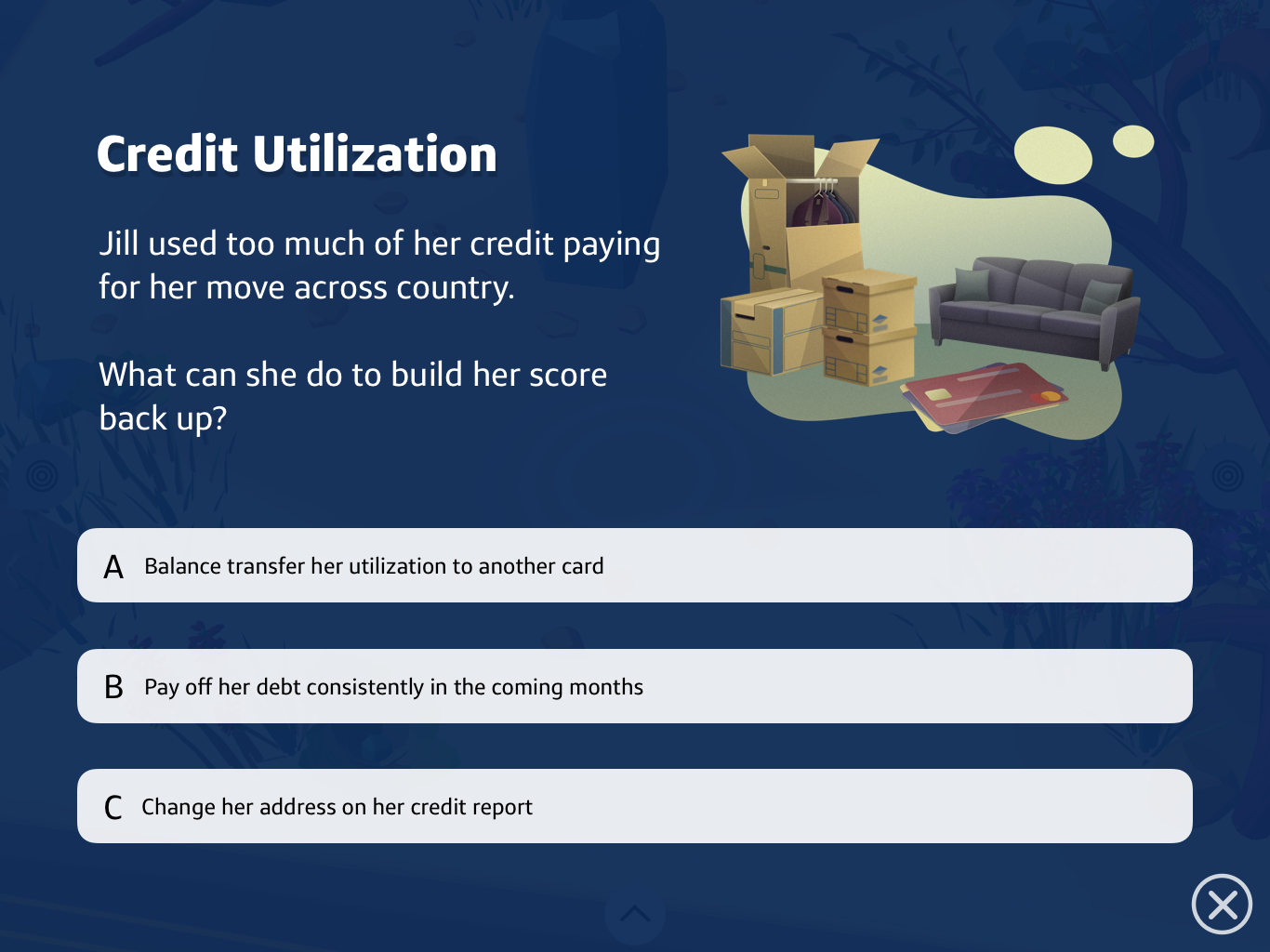

To emphasize the educational points of our experience, I included a quiz component after each character’s life moment. When a customer learned how one of our characters decreased their credit score by missing a bill on time, they would test their own knowledge to provide a solution.

This approach showed better response from branch associates, saying that it provided a much easier hook to ask customers: “Do you want to test your credit score knowledge?” In promising survey results, sixty-nine percent of customers reported that they learned something new about credit scores through our quiz. The quiz questions were pulled from common wrong assumptions about credit in the most recent annual Credit Score Survey, which was conducted by the Consumer Federation of America and Vantage.

Conclusion: Sunset and Sunrise

Even if I was able to improve the user experience of the application, I still found fundamental flaws in our approach. The truth was that customers coming to our café branches weren’t looking for help on their credit scores – they were coming for banking help or maybe a coffee. One customer told me “I feel like people with bad credit scores won’t do it (the experience) and people with good ones will”.

In addition to this, my team’s priorities were shifting towards other projects. This project had only reached prototype-testing phase so I needed to treat it as such. I decided to end the CreditWise AR project. Nevertheless I still believed we learned a great deal about augmented reality’s potential for the future. I gave a presentation to my design organization about the lessons I learned about using AR in our banking context and put forward new future ideas.

I also wrote an internal blog post describing my learnings that was shared company-wide to over a thousand people! Overall I learned that being responsible for a project not only means shipping it, but also knowing when to shelf it for the greater good of the team and regroup.